If you could not link your PAN with Aadhaar, don’t panic. You can link it today only instantly through e-PAN now, sitting in the comfort of your home. The income tax department has introduced the facility of e-PAN to the users. This facility will be made available to them on …

Read More »

Link Aadhaar and PAN before June 30 or pay Rs.5000 penalty

It is compulsory to link your PAN with Aadhaar Card. Even Supreme Court has not objected to it. Do it before June 30, 2018, to avail of the benefits. If you do not, you need to know about the complications it may bring to you. At present, there is no …

Read More »

Aadhaar Virtual ID(VID) to roll out from July 1, can be used for authentication

Aadhaar Virtual ID (VID) is all set to establish itself as the core of element in the country with links established to the bank accounts and even social media such as Facebook for the purpose of verification of identity. This new move towards complete digitization has swooped in to transform …

Read More »

Link your PAN with Aadhaar by June 30 2018, warns IT department

Now you will need to link Aadhaar and PAN to be able to process your annual income tax returns of the current year. The IT department says it should be done till June 30, or you will be treated as a violator of IT return and it won’t be processed. The …

Read More »

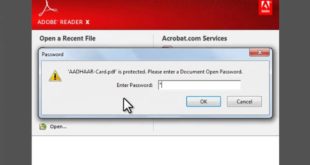

How to open Aadhaar Card PDF File ?

Aadhaar is a 12-digit unique identification number which is issued by the government of India to every individual of India. The Unique Identification Authority of India (UIDAI), which functions under the Planning Commission of India, is the organization which is responsible for managing Aadhaar numbers and Aadhaar Cards. In our previous …

Read More »

How to Link PAN Card with Aadhaar Card ?

Link PAN Card with Aadhaar Card : As you all know a PAN (Permanent Account Number) card is a unique 10 character code that is assigned to all tax payers in India. It is issued by the Income Tax Department of India and links all your transactions that attract tax …

Read More »

How to cancel Online Appointment for Aadhaar Card ?

You might be looking to cancel Online Appointment for Aadhaar Card. Don’t worry in this article we will tell you how to cancel appointment for Aadhaar Enrolment online? In our previous articles we have already discussed about the steps to fix online appointment for aadhaar enrolment and how to reschedule Online Appointment for Aadhaar Card. Currently, the …

Read More »

How to reschedule Online Appointment for Aadhaar Card ?

You might be looking to Reschedule Online Appointment for Aadhaar Card. Don’t worry in this article we will tell you how to reschedule appointment for Aadhaar Enrolment online? In our previous articles we have already discussed about how to fix online appointment for aadhaar enrolment and the Steps to change aadhaar card Name or Address. …

Read More »

How to book Online Appointment for Aadhaar Card Enrolment ?

You might be looking to book Online Appointment for Aadhaar Card. Don’t worry in this article we will tell you how to fix appointment for Aadhaar Enrolment online? In our previous articles we have already discussed about how to change aadhaar card name and address and the process to change aadhaar card …

Read More »

How to download e-Aadhaar Card with Enrolment Number ?

This article mentions easy steps to download e-Adhaar Card by using your Enrolment Number. There might be several reasons why you want to download e-Aadhaar Card like you may have lost your Aadhaar Card or you might have made changes to your existing Aadhaar Card or you may have not received …

Read More »

Amazing India Blog Know India Better

Amazing India Blog Know India Better