Have you ever wondered what your life goals are? They could be anything from starting a business and travelling the world, to improving your finance and health. Regardless of whether your goals are explicit, or vague, one thing is clear- “Prioritizing Your Life Goals is Highly Essential”.

When you prioritize your goals, you basically ask yourself, “What’s extremely important to me?” In responding to this question, it turns out to be clear where you should be devoting your focus and time.Subsequently, you realize the things you’d like to work on and accomplish so as to be happy with your life and who you become!

However, working to achieve a number of goals, particularly, financial ones is quite overwhelming. The solution is to prioritize these goals using “Urgent-Important Matrix”. Even financial planners recommend doing so.

The Matrix of Decision Making

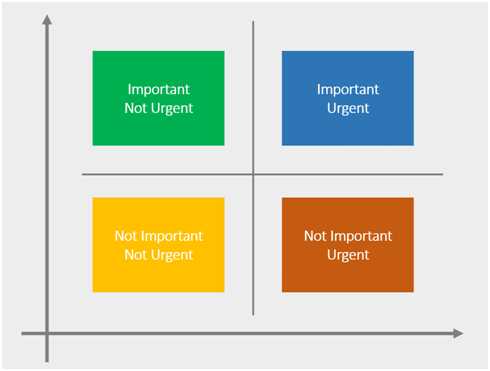

Also referred to as the ‘Eisenhower Matrix’, the Urgent-Important Matrix is an effective tool for prioritizing your goals based on urgency and importance. It is a simple 2 x 2 square, having four quadrants which mirror the degree of urgency and importance of tasks.

You can use this matrix to prioritize your goals better, and shelve the financial to-dos that turn out to be non-essentials.

Important, Urgent

Goals which fall in the blue quadrant are the ones that you should achieve first. Getting out of debt, getting a job and buying life insurance are a few examples of important and urgent to-dos.

Important, Not Urgent

Important but not so urgent financial goals go in the green quadrant. These include goals like buying a home, building an emergency fund, investing towards your future and so forth.

Not Important, Urgent

Red quadrant contains goals that are not important, yet urgent. If procrastinated upon, these goals can prevent you from accomplishing your green quadrant objectives. Goals like getting a credit card that suits your needs or opening a good savings account, are tedious, requiring legwork on your part. However, these goals are basic in helping you deal with your savings and spending.

Not Important, Not Urgent

Goals like buying the latest iPhone Xor other gadgets come under the yellow quadrant. Although goals like these can bring you a sense of fulfilment, you need to consider how vital and urgent,such purchase is to you, compared to your other goals.

Using the Matrix to Prioritize the Pressing Life Goals

Relationship vs Profession

When it comes to relationship vs profession, individuals wind up in a do or die situation.Often, making a priority means forgoing one in exchange for another. For instance, in return for relationship growth, weakening your professional aspirations. But you don’t have to forfeit one aspect of your life for another.

You necessarily need to ensure that your loved one and your profession are equally valuable. Meaning:

- Taking a personal day doesn’t mean you care less about your job or

- Staying late at the office doesn’t imply you rather prefer to be at work

However, considering that professional growth could also positively affect your personal life, we would put profession in the “Important and Urgent Quadrant.”

New Gadget vs. Investment

Shopping for new gadgets will definitely go in the Yellow Quadrant (Not Important Not Urgent). Whereas investments will fall in the Green Quadrant (Important, Not Urgent). The reason for this is that buying a new gadget may give you momentary satisfaction, however, investing the same amount in a prudent market-linked investment like ULIPs or ELSS funds, can help you reap handsome returns over long-term, all thanks to the “Power of Compounding”.

In addition, these investments can provide financial support to cater to your various life goals like:

- Funding your children’s education and/or their marriage

- Buying your dream home

- Planning your retirement

Cover for Life’s Contingencies First

Most important aspects of personal finance are insurance and investments. While both are equally important, ifyou are starting with your career, prioritizing insurance over investments is dependably a sound move. After all, getting life insurance falls in the Blue Quadrant (Important, Urgent).

When you look at the commotion on the road, you take an alternate route,or when you see dark skies, you take the umbrella before stepping out. Much like the umbrella, “Term Insurance” provides financial protection to your loved ones in the event of your demise. Therefore, considering the risks related to the current lifestyle, a brilliant decision is to purchase a term cover to protect against life’s contingencies.

Term insurance pays a significant sum for a very small amount of premium, thus providing financial stability to your dear ones in your absence. Having said that,it’s vital that you purchase the best term plan for securing your family’s future. For this, a thorough comparison of available plans must be made based on the following parameters:

- The reputation of the Insurer

- Availability of Riders

- Flexibility to choose policy tenure and premium payment term

- Claim Settlement Ratio

While all these factors are equally significant, it is the claim settlement ratio of the insurer that ensures a hassle-free settlement process for your loved ones. Hence, it’s wise to go with a trusted insurer having a higher claim settlement ratio. Currently, Max Life Insurance has the highest claim settlement ratio of 98.26% amongst all life insurers.

If you need help calculating the exact cover you need and the premiumyou may have to pay, there are ample term insurance premium calculators available online. By using a term insurance premium calculator, you can select the best deal and easily opt for the right cover that fits your requirements.

So, make use of the term insurance premium calculator to calculate the cover you need and buy the best term insurance plan to secure your family’s future!

Amazing India Blog Know India Better

Amazing India Blog Know India Better