State Bank of India(SBI) is undoubtedly the largest Bank in India with 16333 Branches including 191 foreign offices in 36 Countries. You must already be having a bank account in SBI and you must have also completed the activation of SBI Internet Banking Service. Now, in order to transfer funds or money to any SBI Branch or to any other Branch first of all you need to add a beneficiary in your Internet Banking Account. Only after you add a Beneficiary, you can transfer funds using IMPS, NEFT or RTGS. Today, we will tell you the complete procedure to add a beneficiary in SBI Online.

How to Add a Beneficiary in SBI Online ?

Let’s now know the step by step process to add a beneficiary in SBI Internet Banking Account.

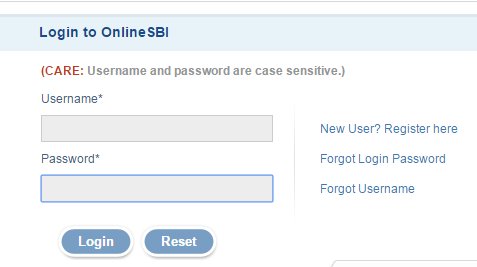

1) Opening the Online SBI Website and Signing into Internet Banking Account

First of all you need to Open the SBI Online Website –> https://retail.onlinesbi.com/retail/login.htm

Click on Continue to Login to reach the SBI Online Login Page.

Please enter your Username and Password and click on Login to Login to your Online SBI Account.

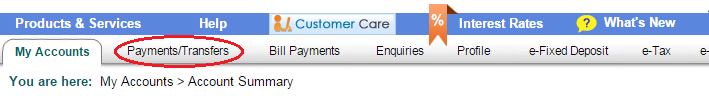

2) Payments/Transfers Tab for Adding Internet Banking Beneficiary

Now, at the top of the Screen you will find a tab named Payments/Transfers. Please click on Payments/Transfers and you will be redirected to another screen. Now, within Funds Transfer you need to click on Inter-Bank Beneficiary to add an Inter-Bank Beneficiary Outside SBI. Please note that Inter Bank Beneficiary means a Beneficiary associated with any other Bank other than SBI. So, we are elaborating on the Process to add an Inter-Bank Beneficiary.

Now, within Funds Transfer you need to click on Inter-Bank Beneficiary to add an Inter-Bank Beneficiary Outside SBI. Please note that Inter Bank Beneficiary means a Beneficiary associated with any other Bank other than SBI. So, we are elaborating on the Process to add an Inter-Bank Beneficiary.

If you want to add your Own SBI account or Any Other SBI Account, you can use those options to proceed. The procedure is the same for adding a beneficiary Within SBI also.

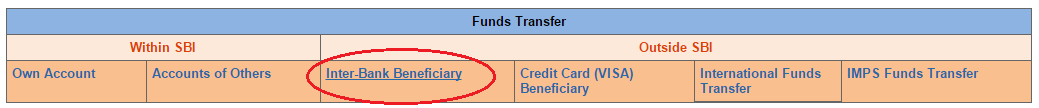

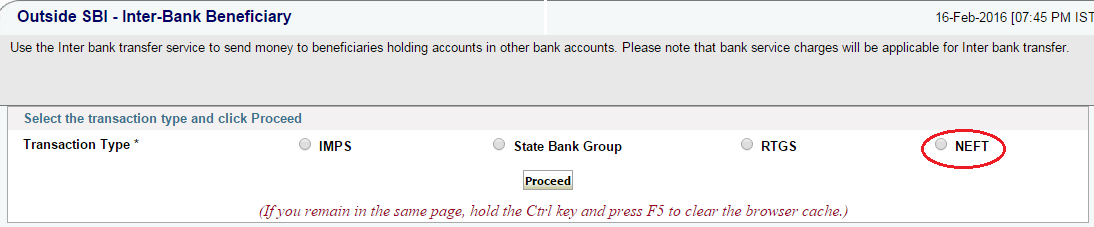

3) Proceeding to Add a Beneficiary for NEFT/IMPS/State Bank Group/RTGS Funds Transfer

Now please select the last Option i.e., NEFT and click on Proceed.

Note : By adding an NEFT beneficiary in SBI, not only you can transfer funds using NEFT but you can also transfer money by using IMPS, RTGS to any State Bank Group Bank or any Bank Outside SBI.

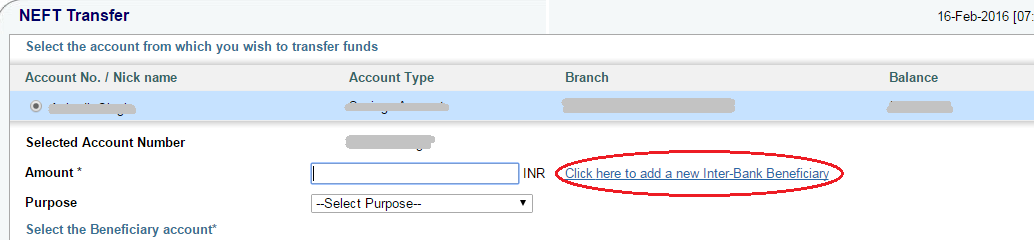

Now click on the link which says ‘Click here to add a new Inter-Bank Beneficiary’.

4) Opening the Online SBI Profile and Entering the Bank Details of the Beneficiary

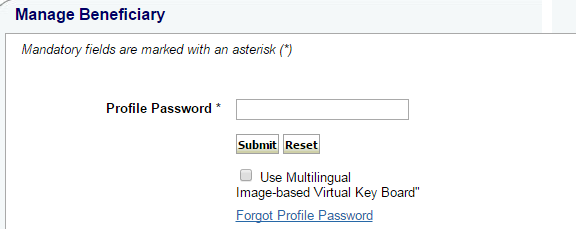

Now, you need to enter the Profile Password on your Online SBI account and click on Submit. As soon as you click on submit, you will be redirected to a page where you will need to fill all the important Bank Details of the Beneficiary whom you want to add.

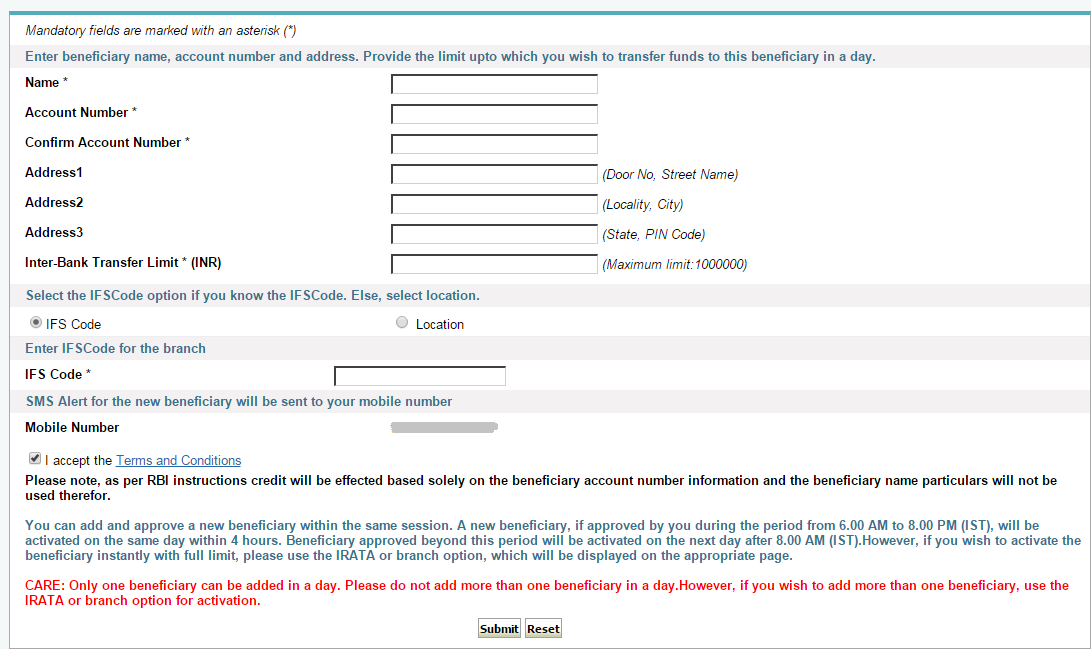

Enter the following Details of the Beneficiary :

- Name : Complete Name of the Beneficiary exactly as in his/her Bank Account records.

- Account Number : Bank account Number of the Beneficiary.

- Confirm Account Number : Re-Enter the account number of the beneficiary.

- Address 1, Address 2, Address 3 : Enter the Complete Address of the beneficiary (This Step is Optional)

- Inter-Bank Transfer Limit : Enter the Maximum amount which can be set to Transfer to this Beneficiary at One time. Make sure that the amount you enter is at max Rs.10,00,000.

- IFS Code : Select this radio Button if you know the Ifsc code of the Branch of Beneficiary’s Bank. Enter the IFSC Code, if you know it. If you dont know the IFSC Code, select the Location radio button.

- Location : In case you don’t know the IFSC Codem, you can Select the Location of the Bank and Branch of the Beneficiary by selecting the Location radio button.

- Put a check mark against ‘ I accept the Terms and Conditions ‘.

- Click on Submit to add the beneficiary.

Note : Kindly note that you can add only 1 beneficiary in a day. Beneficiary can be added instantly by an OTP received on your registered Mobile Number or by IRATA reference number which can entered in any SBI ATM.

5) Approving the Beneficary in SBI Online

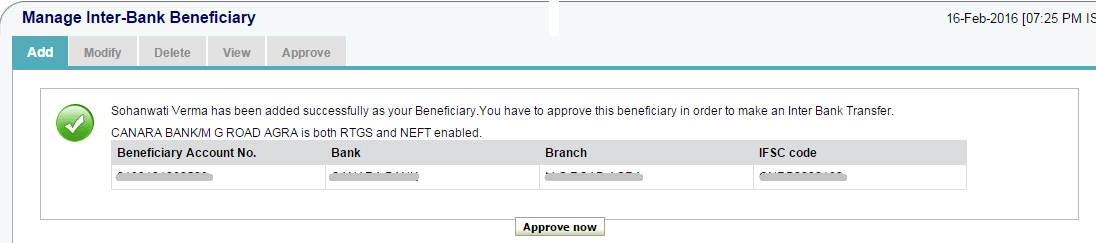

Now that you have completed the process to add a beneficiary in Online SBI, you need to approve this beneficiary in order to make it active for transferring funds.

To approve a beneficiary, you need to click on Approve Now.

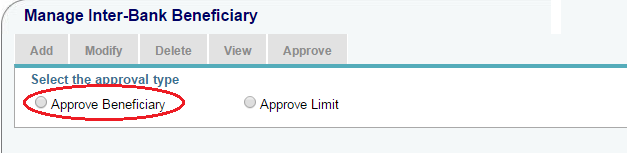

Now, you will find a screen where you will have 2 options i.e., Approve Beneficiary and Approve Limit. You need to select Approve Beneficiary.

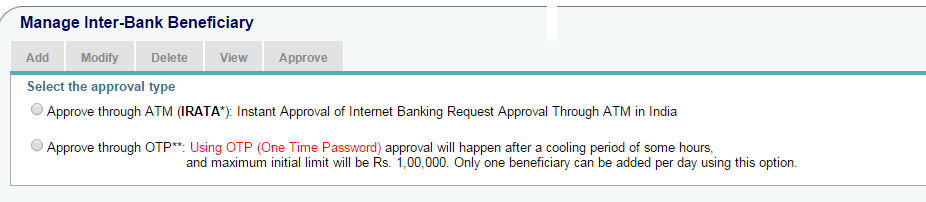

Now you will find 2 Option by which you can approve the beneficiary in SBI Online i.e., Approve through ATM and Approve through OTP.

- Approval through ATM means approval of the Beneficiary by using IRATA Ref. No. (Refer Step 5(a))

- Approval through OTP means using an OTP which is received on your mobile number registered with SBI.(Refer Step 5(b))

5(a) How to approve a Beneficiary in SBI Online through IRATA Ref No. ?

5(a) How to approve a Beneficiary in SBI Online through IRATA Ref No. ?

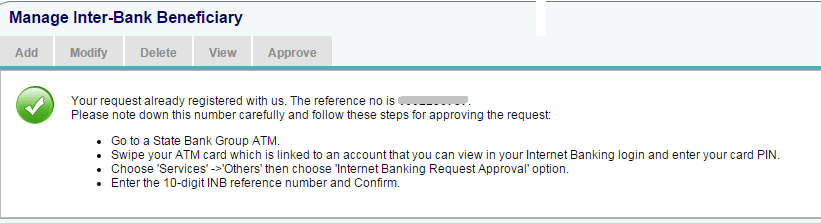

In order to approve a Beneficiary in SBI Online through IRATA Ref No., you need to select the first option i.e., Approve through ATM(IRATA). As soon as you select this option, you will be redirected to another page.

Now, you need to select the Beneficiary to Approve and click on Generate IRATA Ref No.

You will now get the IRATA Ref No. which can be used to approve beneficiary through any SBI ATM.

In order to approve a beneficiary by Using the IRATA Ref No, please follow the following steps :

- Visit the SBI or State Bank Group ATM.

- Swipe your ATM card and chose Service –> Others –> Internet Banking Request Approval.

- Enter your 10-digit IRATA Ref No. and Confirm you’re done !

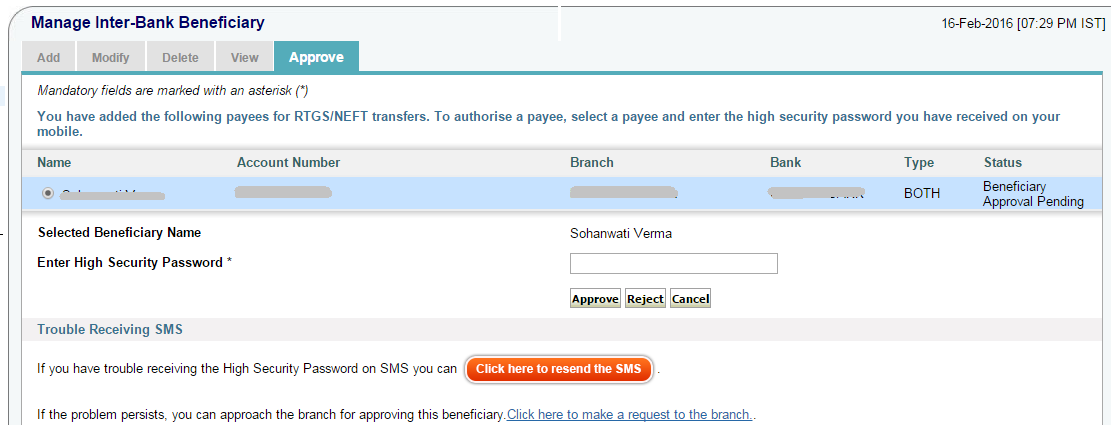

5(b) How to approve a Beneficiary in SBI Online through OTP ?

In order to approve a Beneficiary through OTP, you need to click on the second option (as seen in Step No.5 Above) i.e, Approve through OTP. As soon as you click on it, you will receive an OTP on your registered mobile number. You will need to enter this One Time Password in the box corresponding to Enter High Security Password.

Please click on Approve after entering the OTP and your beneficiary will be approved.

Note : If by any chance, you did not get the OTP you can click on the Red button which says ‘Click here to resent the SMS’ to receive OTP on your Mobile Number.

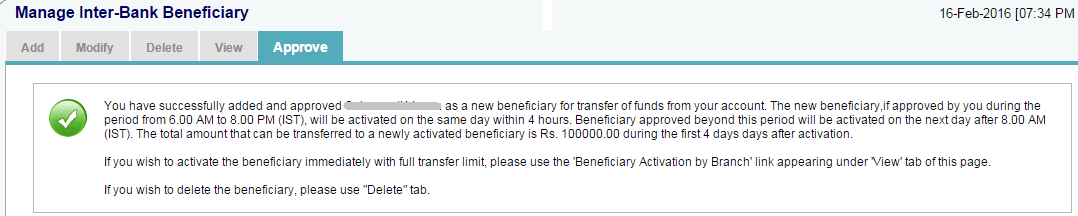

Once the beneficiary has been approved, you will have a message as below saying that You have successfully added and approved a new beneficiary for transfer of funds from your account.

Note : You will be able to transfer funds only after the Activation of the Beneficiary. If the new beneficiary is approved by you between 6:00 am to 8:00 pm, it will be activated on the same day within 4 hours.

Hope the procedure to add a beneficiary in SBI is clear to you. If you have any doubts or queries, you may leave your comments below.

You may also like to Read :

Amazing India Blog Know India Better

Amazing India Blog Know India Better

5(a) How to approve a Beneficiary in SBI Online through IRATA Ref No. ?

5(a) How to approve a Beneficiary in SBI Online through IRATA Ref No. ?