November 17, 2022

Different Types of Insurance Available in India

We may face problems in life and an unexpected situation may disrupt our family’s well-being. Life i…

August 20, 2022

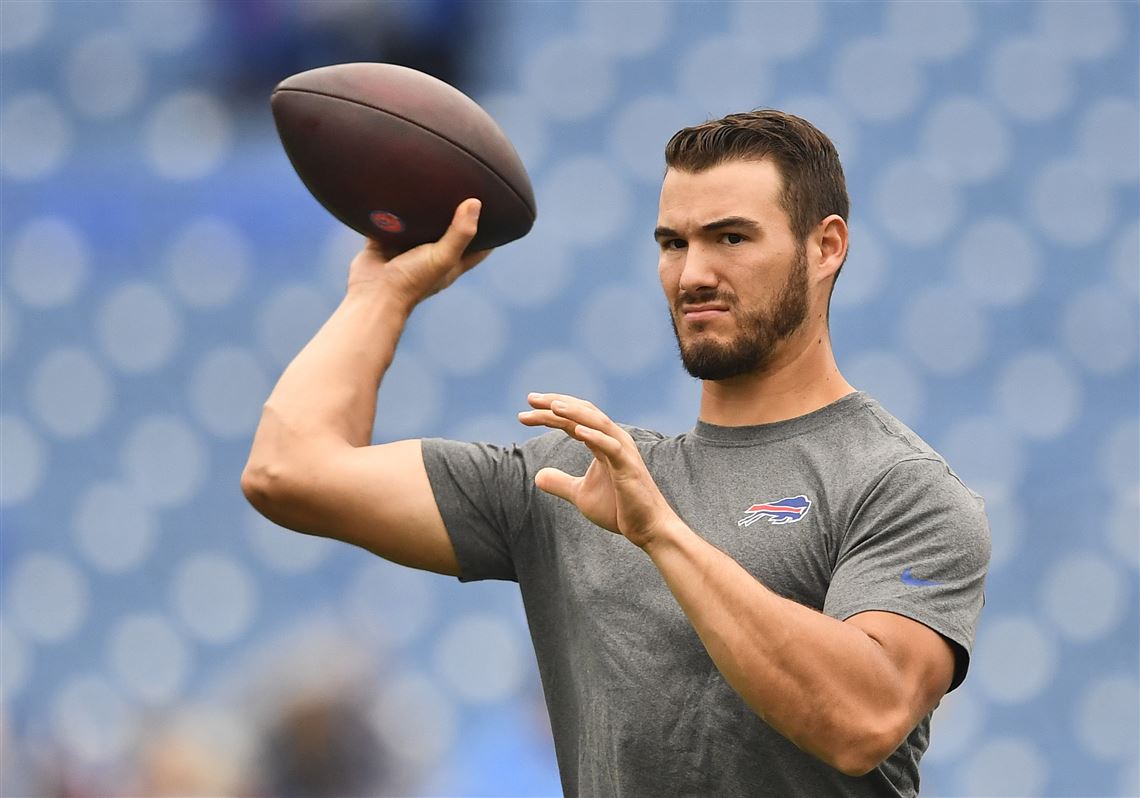

Mitchell Trubisky In Line To Be the Pittsburgh Steelers Starting Quarterback

Ever since the beginning of NFL training camp, a lot of people have been questioning who would poten…

August 20, 2022

Jimmy Garoppolo Expected To Be Released, Where To Next?

San Francisco 49ers head coach Kyle Shanahan and general manager John Lynch have made things clear t…

August 20, 2022

2022 MLB Division races enter dog days of summer

Late-season collapses are immortalized in baseball lore. What used to make the baseball season so ag…

August 20, 2022

Kevin Durant Speaks With Brooklyn Nets Ownership, Wants a Trade

Kevin Durant recently met with Brooklyn Nets Ownership about his displeasure with the franchise. He …

August 20, 2022

New York Giants Fight Breaks Out In Training Camp and What It Means

In every training camp, there is nothing that is always smooth sailing. There will always be some bu…

June 27, 2021

In 1st Drone Strike At An Indian Military Base, 2 Blasts At Jammu Airport

Jammu: The Indian Air Force (IAF) is investigating what could be the first ever drone attack on any …

February 19, 2021

Good News for India as Kenya Sweetens Safari Deals for Indian Tourists

Indian travelers have increased their uptake of Kenya’s tourism products in recent years. This incre…

September 14, 2020

Microsoft Surface Duo teardown reveals ‘refreshingly simple hinge design’

iFixit has revealed a few insights on a Microsoft Surface Duo, letting us have a look at what is ins…

August 24, 2020

The digitalization of BFSI in India and the role Forex plays in it

India is well-known for its ambitions to go digital in the coming years. This opportunity is greatly…

August 15, 2020

Mahendra Singh Dhoni announces his retirement from International Cricket

MS Dhoni announced his retirement from international cricket on Saturday, as he brought the curtain …

July 8, 2020

Will the recent Chinese app bans spiral out of control?

India and China are the world’s most populated countries. The two have been going at it about a terr…

July 2, 2020

Virgin Galactic will livestream its SpaceShipTwo cabin reveal on July 28th

“Ultimately, the interior of the spaceship was designed with one primary goal in mind, and that is t…

July 1, 2020

Will help creators in India till interim ban in place: TikTok CEO

New Delhi, July 1 (IANS) TikTok CEO Kevin Mayer on Wednesday said that the company is working with v…

July 1, 2020

GST collection drops 9% to Rs 90,917 cr in June

New Delhi, July 1 (IANS) The COVID-19 induced shrinking of economic activity for past few months has…

July 1, 2020

Suzlon completes debt restructuring, shares hit 5% upper circuit

New Delhi, July 1 (IANS) Debt-laden wind power solutions provider Suzlon Energy has completed its de…

July 1, 2020

World Bank offers $750 mn loan for India’s covid-hit MSMEs

New Delhi, July 1 (IANS) The World Bank’s Board of Executive Directors has approved a $750 mil…

July 1, 2020

US hit by wave of big ticket bankruptcies (Ld)

New Delhi, July 1 (IANS) The US is witnessing a wave of bankruptcies of erstwhile storied names espe…

July 1, 2020

Indians for India products, ecommerce must tell country of origin: HC plea

New Delhi, July 1 (IANS) The Delhi High Court on Wednesday sought response from the Centre and vario…

July 1, 2020

Homegrown social media apps turn restless for big leap

New Delhi, July 1 (IANS) The ban on 59 Chinese apps has given homegrown app developers a once-in-a-l…

July 1, 2020

Hitachi Vantara names ex-Cognizant executive Gajen Kandiah as CEO

San Francisco, July 1 (IANS) Hitachi Vantara, a subsidiary of Japanese tech conglomerate Hitachi Ltd…

July 1, 2020

ZEE5 announces TikTok rival HiPi for Indian users

New Delhi, July 1 (IANS) Entertainment app ZEE5 on Wednesday announced a short video-sharing platfor…

July 1, 2020

Parvin Dabas judges virtual film fest

Mumbai, June 30 (IANS) Actor Parvin Dabas had an “amazing” time while judging a virtual …

July 1, 2020

Sushant Singh Rajput case: Shekhar Kapur to be quizzed, Sanjana Sanghi grilled for 7 hrs

Mumbai, June 30 (IANS) Mumbai Police will record the statement of filmmaker Shekhar Kapur as part of…

July 1, 2020

When Anupam Kher broke barricade to hug MJ

Mumbai, June 30 (IANS) Actor Anupam Kher has shared a memory of how he “broke the barricade, j…

-

Different Types of Insurance Available in India

We may face problems in life and an unexpected situation may disrupt our family’s well-being. Life is unpredictable and so are the conditions. To overcome or face such scenarios we have different types of Insurance like life, health, general, and … Read More » -

Good News for India as Kenya Sweetens Safari Deals for Indian Tourists

-

The digitalization of BFSI in India and the role Forex plays in it

-

Will help creators in India till interim ban in place: TikTok CEO

-

GST collection drops 9% to Rs 90,917 cr in June

-

Suzlon completes debt restructuring, shares hit 5% upper circuit

-

World Bank offers $750 mn loan for India’s covid-hit MSMEs

-

Microsoft Surface Duo teardown reveals ‘refreshingly simple hinge design’

iFixit has revealed a few insights on a Microsoft Surface Duo, letting us have a look at what is inside the device. A notable finding of one of the team members is that the dual-screen device comes with ‘refreshingly simple … Read More » -

Will the recent Chinese app bans spiral out of control?

-

Virgin Galactic will livestream its SpaceShipTwo cabin reveal on July 28th

-

Homegrown social media apps turn restless for big leap

-

Hitachi Vantara names ex-Cognizant executive Gajen Kandiah as CEO

-

ZEE5 announces TikTok rival HiPi for Indian users

-

Parvin Dabas judges virtual film fest

Mumbai, June 30 (IANS) Actor Parvin Dabas had an “amazing” time while judging a virtual film festival for independent filmmakers. “It was amazing. I saw so many outstanding films. There were a wide variety of films, especially the ones made in … Read More » -

Sushant Singh Rajput case: Shekhar Kapur to be quizzed, Sanjana Sanghi grilled for 7 hrs

-

When Anupam Kher broke barricade to hug MJ

-

Namit Das: Was ‘privilege’ working with ‘true gentleman’ Chandrachur Singh in ‘Aarya’

-

Is Urvashi Rautela’s new film inspired by Emma Stone’s ‘Easy A’?

-

While India Is On Lockdown, Olive Ridley Turtles Start Nesting On Odisha Coast

With the reduction in pollution levels due to lockdown amidst coronavirus outbreak, marine life is reviving and recouping with peace. Sea turtles of the Olive Ridley breed have arrived happily ashore to mass nest at the 6 km … Read More » -

Ozone layer heals as humans stay indoors amid coronavirus outbreak

-

7.8 magnitude earthquake strikes near Russia’s Kuril islands; no casualties reported

-

South Africa launches World’s largest radio telescope

-

You missed a solar eclipse? Get ready for a lunar eclipse on July 27-28

-

India, China military talks went on for 12 hours

New Delhi, July 1 (IANS) Talks between the Indian and Chinese military delegates to resolve the border issue in Eastern Ladakh went on for around 12 hours, sources said. The meeting which started at 10.30 a.m. ended at 11 p.m. on … Read More » -

Bengal BJP chief allegedly attacked by Trinamool men

-

JD-S, LJD all set to unite again in Kerala

-

Mann Ki Baat Live: I apologise to poor of the country for coronavirus hardships, says PM Modi

-

Centre approves Rs 5,751 cr additional calamity relief for 8 states including Kerala

-

G20 leaders to convene remotely as coronavirus cases near half a million

-

Coronavirus | Narendra Modi announces WhatsApp helpdesk number for providing coronavirus information

Amazing India Blog Know India Better

Amazing India Blog Know India Better